Mastering the Product Interviews - Solving Market Sizing Questions

Part 2 of 2

👋 Hey, I am Deepak, and welcome to another edition of my newsletter. I am writing a series on Mastering the Product Interviews. The first post around estimations can be found here.

Before we start, I'd like to make a quick announcement!

The applications for the next live cohort of the Advanced Growth Program are open now. It's a unique learning experience via custom learning software and live classes. About 300+ experienced PMs have gone through the program and loved it.

In 1980, McKinsey & Company was commissioned by AT&T to forecast cell phone penetration in the U.S. by 2000. AT&T’s Bell Labs had invented cellular telephony. The McKinsey’s prediction was 900,000 subscribers. Based on this prediction, AT&T decided there was not much future to the cellphones. And how off was the prediction? It was > 100x off from the actual figure, 109 Million.

A decade later in 1993, to rejoin the cellular market, AT&T had to acquire McCaw Cellular for $12.6 Billion. By 2011, the number of cell phone subscribers worldwide had surpassed 5 Billion.

Market Sizing is a Tricky Business

Forecasting market size is tricky because we have little idea around how the future will pan out. Hundreds of pieces from reputed sources have been written about why predicting the future is hard to predict. In a way, we have made our peace with it. And I hope that after reading this piece, you would be little skeptical to such market predictions about future.

But what about sizing the current market? While it looks an easy thing to do, we will see examples in the post that it’s harder to size the market correctly in the case of an innovation.

PMs are in the business of innovation. And that’s why it becomes important for them to exercise this muscle. A good estimation of market for a new product line could be the difference between a red light and a green light within the organisation. Years down the line, a good estimation could also be the difference between a successful product and a failed one.

And with that, let’s start!

Types of Market Sizing Problems

Market sizing problems can be of two types:

Market sizing for incumbent products : This is what traditional case questions look like. The questions is about an existing market. An example of this is — How many fridges are sold every year in India?

Market sizing for innovation products: This is when you introduce a product in the market that doesn’t exist. An example of this is — Google has built a teleportation device which can instantaneously moving things from one location to another. Estimate the market size of this device.

The innovation product market sizing are quite relevant for PMs in their jobs, and like we mentioned earlier, it’s also the harder thing to do. The good news is that the same framework can be applied to both types of market sizing. Next, let’s cover the framework to do the market sizing that’s applicable to both types of market sizing.

Approach for Market Sizing Problems

The approach for incumbent as well as innovation products is similar, if not the same. Here are the steps you can take:

Step 1: Clarify what the product is — If you can’t describe the product offering well, you wouldn’t be able to size the market. For example, in the teleportation device market sizing, you have to understand it’s capabilities and limitations.

What’s the maximum distance it can teleport?

Does it teleport living as well as non-living things?

What’s the weight and volume limit?

Does it need a particular tunnel like Hyperloop, or can it teleport through air/water/solid/vacuum?

Depending on the answer to the questions above, the customer problems that the product solves will change, and the final market size will change. As an example, if it can only transport things with weight <10 kg, the market gets significantly limited as compared to when it can transport up to 100 kg.

Step 2: Clarify who the end user is — The second step is the discussion about the user of the product. Who exactly is the user? Identify the consumer segments for whom the product solves the problems.

Does it serve businesses (B2B) or consumers (B2C)?

In the B2B market, the segmentation can be further done in terms of size of the company, type of the business, annual revenue, etc.

In case of a B2C market, the segmentation can be demography based or behavioural.

Demographics: On the basis of age, gender, income

Behavioural: On the basis of their behaviour and attitude

There are two important things to remember in segmentation:

First, while the segmentation can be done in multiple way, you should choose one that’s relevant to the product. For example, while estimating the new fridges sold in India, the age based segmentation isn’t of much value. We have to look at income levels of households and estimate starting from those who can afford a fridge.

Similarly, while segmenting users for a dating app, we have to segment them at a behavioural level. There could be segment interested in casual dating, whereas others looking for serious partners.

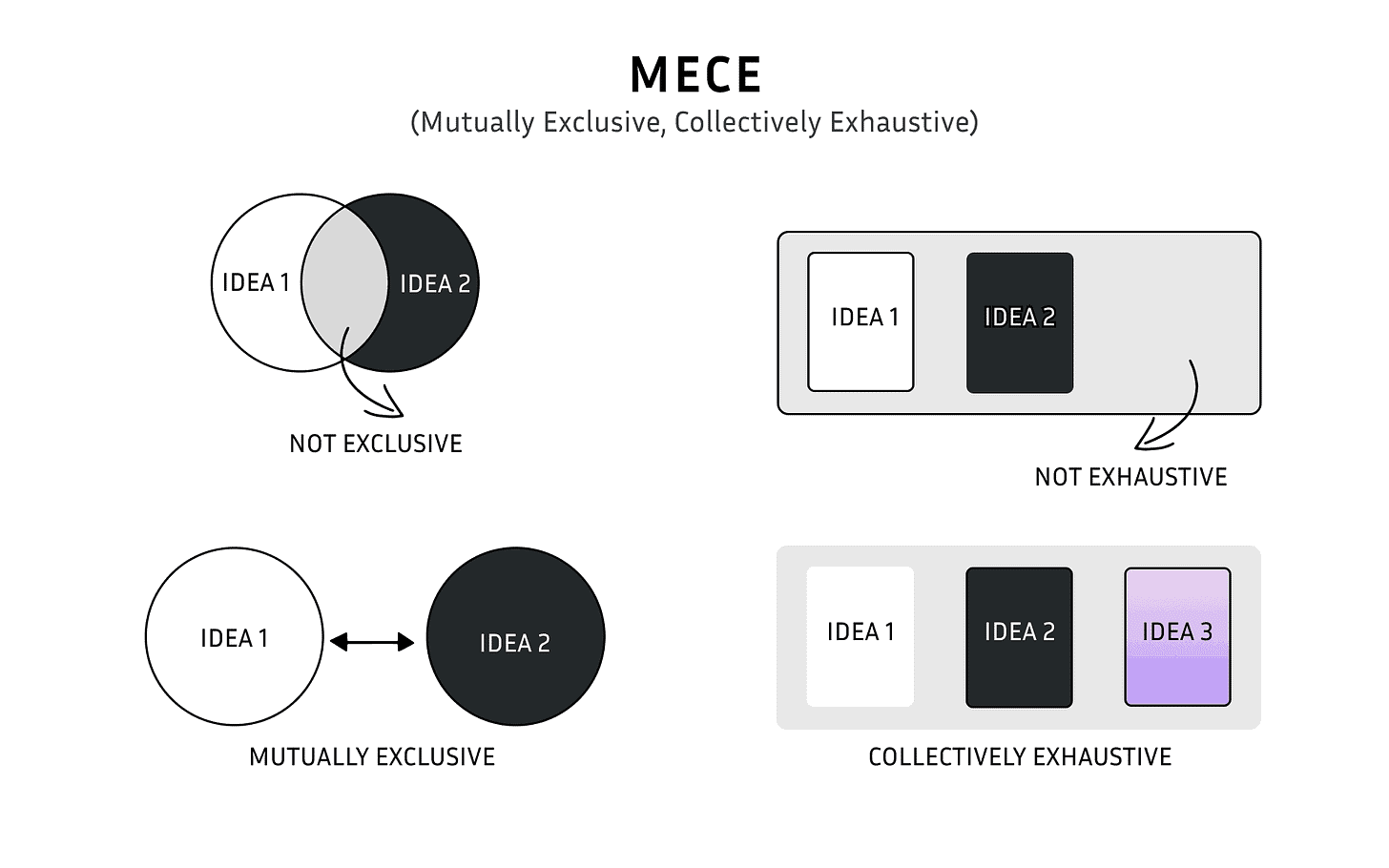

Second, while doing the segmentation, it is also important to take the MECE segments (mutually exclusive, collectively exhaustive). In absence of MECE, you will end up double or triple counting few numbers. Age based or gender based segmentation is MECE as one consumer will fall in only one segment. On the contrary, if we do a segmentation based on people buying premium vs economic brands, we might be double counting people who fall in both categories.

While you can always ask the interviewer on who the user is, PM interviewers usually ask the candidate to pick the relevant market segments based on the problem the product solves. In such cases, the interviewers wants to check your judgement. This is similar to PM job where you won’t get this clarification from someone else, but will have to pick it for yourself and justify. So don’t ask too many questions if they ask you to make an assumption yourself. Pick the segment and explain why you picked the segment.

Step 3: Clarify other variables like time and location — This is the last step of clarification phase :)

It is important to ask the geography and timeframe within which we want to evaluate the market size. A good advice is to pick a market you are already familiar with, especially when it comes to age distribution, digital penetration, and income distribution. You can go through the last post to get those data for India and US market if you haven’t done so already.

It is also good to check whether we are looking to get the market size in terms of volume (number of users/ units), or value (revenue).

Step 4: Identify the channels (Optional) — Once we have clarity around the product and the consumer, we have to ask — how will the product reach the customers? This step is optional because if it’s a purely digital product like a social media or messaging app, you know that the channel to acquire customers will be purely online. But if it’s a physical product, you need to list the channels using which the product is sold. Is it online vs offline vs omni-channel? The answer will change the market segment apt for the product.

For example, new fridges sold online exclusively is a different market than new fridges sold offline. It’s important to clarify this while solving the problem.

Step 5: Pick the approach for estimation — This step is the most crucial for the estimation. Usually, there are two decisions you need to make while picking the approach:

Should you pick demand or supply side estimation?

Imagine that we are talking about the new fridges sold in India.

Do we want to pick the number of suppliers and multiply it by # of fridges sold by each supplier?

Or do we want to take demand side of the equation i.e. number of fridges in the country / lifespan of a fridge?

A general rule of thumb is to pick the side where you are able to obtain the variables by general observation of the world. In the fridge example, it’s hard for you to get total number of suppliers and average number of fridge sold by supplier through general observation. It’s easier to take demand side approach where we take the # of households that can afford a fridge and calculate from there. In certain cases, supply side estimations can work. But most of the times, demand side estimations work in interviews.

You should note that it’s not that supply side estimations aren’t useful. Supply side estimations are more useful at the real PM job where you have data available for major players in a market, and their market share. For example, in markets where there are a few large players, supply-side estimation based on these player’s revenue can provide a fairly accurate measure of the market size. It works in real life because sales figures are often available through company reports, industry reports, or regulatory filings. These figures can’t be fetched in the real interviews from an intelligent guess.

Should you pick a top-down versus bottoms-up approach? The answer to this question also ties to — take the approach where you can make intelligent guesses through general observation.

For example, in the case of new fridges sold every year in India, you can start at the top by looking at number of households, and income distribution of households. But imagine that you have to estimate the # of shampoo bottles sold. You have to start with the estimating the consumption per person, and then move upwards.

The next two steps are easy and not different from what we covered in part 1.

Step 6: Draw the issue tree and calculate. Pick easy numbers that are justifiable.

Step 7: Perform sanity check

I believe doing an estimation for an incumbent product should be fairly easy once you follow these steps, so let’s focus on an innovation product market sizing.

Calculating Market Size for Teleportation Device

Let’s apply the above framework in teleportation device market sizing for Google.

Step 1: Clarify what the product is : In the case of teleportation device, here is the summary you got from the interviewer

What’s the maximum distance it can teleport? 5 km

Does it teleport living as well as non-living things? both

What’s the weight and volume limit? up to 150 kg in one go

Does it need a particular tunnel like hyperloop, or can it teleport through air/water/solid/vacuum? It can teleport through air/water/solid/vacuum

As we understand the capabilities of the product, it becomes clear that it can be used for short distance transportation, but it can’t be used as a replacement for inter-city or inter-country travel. But just to make sure we are on the right track, we can clarify it.

While there is a possibility that we can create long-distance transportation by connecting a series of such devices. Like 100 devices can be connected in a row taking the person to 500 km. The experience might be problematic with the person reappearing at each device and then moving on to next. So I am going to ignore the long-distance travel use-case. Is that okay? Yes, that’s okay.

At this point, you can also ask the interviewer to describe the product's share and how it works.

Interviewer: It’s kinda like a telephone booth. You enter into it, key in the coordinates, swipe the card, and move to the next location. Pretty similar to how it happens in Matrix.

Step 2: Clarify who the user is — In this step, you can ask the interviewer on whether we have already decided on the market or it’s an open question. Suppose it’s an open question, we have to pick the relevant users. We already understand what problem the device solves — short distance travel of humans.

What else are we missing before we narrow down to the target segments? Pricing!

At this point, we can ask for pricing parameters of the product. The answer from the interviewer can be as straightforward as $5/km, or the interviewer can ask you to set the pricing. To set the pricing, we need to go deeper into how to price a product, and that’s not very relevant to current market estimate. So we will skip that for now, and assume that we have the pricing set at $5/km of travel.

For $5/km, the cost of an average ride would come to $25 for 5 km. Who would be willing to pay this price?

In the Indian market, we pay anywhere between $5-7 for a ride. It’s too expensive for everyday travel in India. What about the US market? If you are sitting in India and estimating for US, estimate based on the fact that US has a price parity of 3x wrt India (price parity is an indication of how expensive one market is as compared to another market). So the price of a cab ride in US can be $15-20. Because the teleportation device saves so much time, people or their companies would even be willing to pay a premium of 30-50%. So it’s safe to assume that people would be willing to use the teleportation device in the US market. Other markets that are good for this are Europe and China, which are large markets with high capita income.

What about transporting other goods through this device? The metals and other items are usually heavy and per kg travel cost for them would be a lot cheaper than a taxi ride, so let’s not go there for now.

So we have picked everyday travel as the market segment to go after.

Step 3: Clarify the time and geography variables — Based on pricing, we know that we can start with the US market. That said, it’s easier for us to scale in other high capita markets like Europe, China, Canada, etc.

At this point, it would be important to narrow down the geographies further. The reason for that is because the behavior of users vary based on geography when it comes to everyday travel. We know that people in tier-1 cities spend money on taxis. The propensity to spend is much lower in tier-2 and suburbs. People in such areas either use their own transportation, or use public transport. In addition, the volume of everyday travel and trips per square km is usually higher in cities. That’s the reason Uber started in New York and expanded in cities first.

So rather than estimating for the whole US, we can start with the market size for a city only. We can always go back and calculate for tier-2 and above if need be.

Step 4: Identify the channel — we will skip this step as it’s pretty obvious on how customers will reach the product, and vice versa.

Step 5: Pick the approach — We will go for demand side calculation here because we can make a lot of good guesses based on general observation.

Population of a city > 5 million

Let’s segment the population

Below 5 years (7.5%) — Kids below 5 years of age can be excluded since they stay at home.

5-15 years of age (15%) — School kids travel via buses which are usually cheaper. So we can exclude this segment.

15-20 years of age (7.5%) — College kids who usually need to travel within campus only. So we can exclude this segment.

20-65 years of age (50%) — This is the working population that needs to travel everyday. We have go deeper into this segment.

65+ years of age (20%) — They need to travel occasionally once they retire so we can exclude them as well.

Pro Tip: Note that while you can include a small percentage from retirees and college kids, you need to be careful in doing so. They won’t contribute much to the market size, but can take a good amount of time in interviews.

Within the 20-75 year of age segment, around 70% is the working population (80% of males are working, and 60% of females are working + 50:50 ratio of population). Rest are unemployed or choose not to work like housewives. That gives us 3.5 million (5 million * 70%) working population.

An average working person can takes 2 rides a day, 25 days a month. So they would need to spend 50*$20 = $1000 per month on taxi rides. That comes to around $12000 per annum. We can assume that only people earning > $100-150 k would be willing to incur such an expense. Looking at the US distribution of income, this is around 10% of population. In major cities, this number can be higher, say 20% of working population. So the qualified segment becomes 3.5 million * 0.20 = 700 k people

We have 700 k people spending $12000 per annum. That makes it $8 billion per annum from a city of 5 million people.

In the US, we can assume that around 30% of population lives in such cities, i.e. 300 million *30% = 90 million. So the market size of US, provided the device is launched in cities, would be 90 million/ 5 million * $8 billion = $ 144 billion

US economy is large and it’s per capita is pretty high as compared to other large economies such as Chine, India, or Europe. Maybe we can add 20 more cities to such list. So the total market size would come to $300 billion in total.

Step 6: Calculate : we have already done it.

Step 7: Do a sanity check : In this we will need to look at few assumptions:

We have taken price per ride as $20-25, and that’s limiting the market to individuals with high salaries. Is it possible to reduce it? If yes, that can significantly increase the market size.

We have assumed that all individuals who have the ability to pay will choose such option. In real-life, a lot of people prefer public transport especially in cities where it’s pretty good. Many people prefer the comfort of their cars.

Many people would need to walk as compared to getting directly in an Uber. We have assumed these booths are stationary. If they were mobile, the utility could increase because they can be placed in high traffic areas depending on the time of the day. We aren’t sure if that is possibility but that can change the numbers.

We have assumed that expansion to other cities across the globe is possible. In reality, there could be regulatory bodies or other rules preventing that.

We haven’t included other smaller cities or countries with high capita income. They will also expand the market.

All in all, we can take a lower adoption in qualified segments (say 60%), and also take a cut in the final numbers (70%). So the final number comes around $300 billion *0.6 *0.7 = $130 billion.

If you have gone through the calculations, it would be fair to say that market sizing for an innovation is a lot more tougher than an incumbent. But that’s where PMs add significant value. If you become better at it, you can spot opportunities easily and size them up. In other words, you can build the ability to take your company from X to Y.

General Guidelines for Estimation Interviews

Here are the general guidelines for the interviews:

Think loudly. Share your thought process as you tackle the problem. This keeps the dialogue lively for the interviewer. It also demonstrates your thought process to the interviewer, and they can nudge you if they want you to go in certain direction.

Know that it’s fine to pivot your strategy if you discover a more viable direction.

Keep your numbers easy for easier calculations. It is perfectly acceptable if you working with rounded figures.

Remember the broad numbers for key geographies like US and India.

How to Practice and Be Better at Estimates

Here is what I recommend on how to practice estimates.

Phase 1: Start with practicing by yourself slowly. Think about numbers/stats that are available on the Internet and solve them here. Take as much time as you need. You need to think carefully at first.

Phase 2: Start timing yourself when solving these problems.

Phase 3: Interview with peers

Phase 4: Interview with experts

Phase 5: Get to a real interview

Books around the topic

I only recommend the books I have read personally. So feel free to drop a suggestion in comments if you have found any other terrific book on the topic of market size estimations, and estimations in general.

One book that’s classic around market sizing problems is Case in Point. This book is more relevant for incumbent product market sizing, but it is a good start!

A Word of Caution

Most videos and articles about estimates are filled with brilliant examples, and in many cases the estimates are adjusted after the author looked up the true answers on the Internet. Add to that, there is also a selection bias — people do these estimates and throw out the ones that are way off, or don’t look good.

And that makes it hard to get a realistic picture of how good you are when interviewing. What does it look like in the real interviews when someone isn't “looking” / “cheating”.

I hope you have more realistic expectations of what it's like to do guesstimates when you're just getting started. That will make things pretty exciting when starting out.

Hope you liked it! See you next week,

Deepak

Hi In step 5,

An average working person can takes 2 rides a day, 25 days a month. So they would need to spend 50*$20 = $1000 per month on taxi rides. That comes to around $12000 per annum. We can assume that only people earning > $100-150 k would be willing to incur such an expense. Looking at the US distribution of income, this is around 10% of population. In major cities, this number can be higher, say 20% of working population. So the qualified segment becomes 3.5 million * 0.20 = 700 k people

We have 700 k people spending $12000 per month. That makes it $8 billion per month from a city of 5 million people.

So this should be $12000 per year right ?