For the new ones here — 6,000+ smart, curious folks have subscribed to the growth catalyst newsletter so far. If you are new here, receive the newsletter in your email by subscribing 👇

You can read all the posts from the past here - https://www.growth-catalyst.in/archive

Studying the tech firms that have made their mark over the last 20 years can provide unique insights into the present and future of the strategy.

But the factors that constitute a good strategy keep changing as the world changes. To understand it better, we have to go way back.

Before 21st Century

Strategy till 19th century has mostly been about winning wars. We covered it in one of the earlier post called ‘The Litmus Test of Good Strategy’

In the 19th century, factories came into existence due to industrial revolution and the businesses started thinking about competition and strategy. They identified some of the sources of competitive advantage like

Getting a Patent/ IP: Patents came into existence in the late 18th century. Having a patent meant no one else can create the same product and sell it except the ones who hold the patent.

Cost leadership — Producing cheaper products leads to high profit margin. When the benefits are passed to consumers, cheaper products usually sell more.

Undue advantage due to location, cash, or both — Manpower, policies and tax benefits, ability to sustain for a longer period of time, cash for launching new products, etc, can become an undue advantage.

Economies of scale to lower the production cost — Setting up a manufacturing plant requires upfront capital (fixed cost). Production at scale leads to better negotiations and pricing from suppliers, lower fixed cost per item, etc. This usually leads to an overall lower cost per item and builds cost leadership.

As we entered 20th century, the landscape changed again. We moved beyond iron, steel, cement industries and started manufacturing machines like cars, sewing machines, radio, TV, etc for masses. This led to new sources of competitive advantage like

Excelling in a niche product through differentiation and focus — Iron, cement, steel, etc are commodity products and don’t have much differentiation. Products like cars, radios, TV can have differentiation. Companies that has differentiated products and appeal to a certain audience (niche) usually end up gaining the market share and a competitive advantage.

Brand value in the long run — If a business is able to build a strong brand value so that people can trust and buy from you again and again, it leads to strong competitive advantage because people aren’t willing to try the substitutes.

20th Century and The Rise of Network Effects

As the world became more connected in the 20th century, few industries got a strong competitive advantage — network effects.

Network effect means that as more number of users join a network and start using a product, the value that the users can get out of the product increases.

The initial network effect could be seen in newspapers, magazines like New Yorker. As more people read the same newspaper, they could hold conversation with each other around similar news which meant usually a better conversation.

The true network effects could be seen in telephones. Here is the story of telephones growth in the early 1900s.

In 1877-78, the first telephone line was constructed, the first switchboard was created and the first telephone exchange was in operation. Three years later, almost 49,000 telephones were in use. In 1880, Bell (in the photo below) merged this company with others to form the American Bell Telephone Company and in 1885 American Telegraph and Telephone Company (AT&T) was formed; it dominated telephone communications for the next century. At one point in time, Bell System employees purposely denigrated the U.S. telephone system to drive down stock prices of all phone companies and thus make it easier for Bell to acquire smaller competitors.

By 1900 there were nearly 600,000 phones in Bell’s telephone system; that number shot up to 2.2 million phones by 1905, and 5.8 million by 1910.1

The massive rise of telephones from 1900 to 1910 can be attributed to network effects. As more people had telephone lines in their home, it became convenient to dial all those and talk to them instantly, i.e. the value that the users can get out of the product increased. This would increase the value of having a telephone and become more appealing for the rest who didn’t have it.

Network effects became super important when the Internet — mother of all networks, came into existence.

The Internet

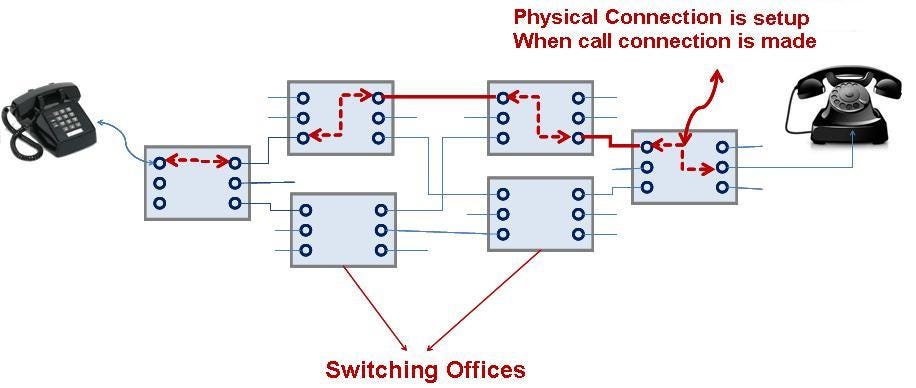

The telephone network relied on one-to-one connection through circuit switching.

A physical 1-on-1 connection needs to be made from one telephone to the other through wires for users to talk to each other. This meant that you could talk to just one person at a time.

Internet allowed multiple computers to be connected to each other at the same time, thereby building a vast network of computers.

This would mean that the information could travel from one computer to another without having a dedicated 1:1 connection. A single computer is connected to millions of computers and could fetch information from all of them. This led to massive network effects. Today, it’s almost unimaginable to live without the Internet.

In order to understand the strategy for internet products, it’s important to understand network effects very well.

More on Network Effects

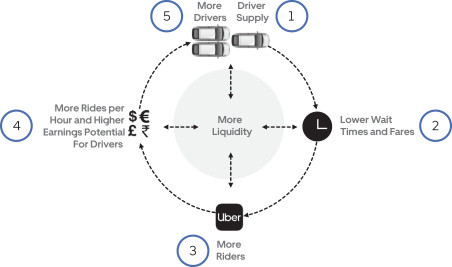

Increasing users —> increasing value is called direct network effects. There are indirect network effects as well. They occur when a platform or service depends on two or more user groups, such as producers and consumers, buyers and sellers, or users and developers. As more people from one group join the platform, the other group receives a greater value amount. The examples of indirect network effects are the e-commerce and ride-sharing products.

A strong network becomes a strong source of competitive advantage. But are there any other factors beyond number of users that make network effects stronger? A way to answer this question is to think about factors that make it harder for the user to switch a network. The higher the switching cost, the higher is the probability that the user will stick with the current product.

Switching costs in a network are affected by four factors — direct vs indirect, frequency of usage, need vs good to have, learning curve.

Direct network effects are stronger than the indirect ones because they require all users to switch the network in order to move to a different product. A user can go to multiple eCommerce platforms like Amazon and Flipkart, but they don’t go to multiple messenger platforms every time they have to message.

A high frequency of usage ensures continuous value creation for the entire network. It builds high recall and habit. Most importantly, a high frequency product leaves little time window for the entire network to switch to another product and start using it. An example of this has been launch of Signal as a competitor to WhatsApp. Even if millions of people downloaded signal within a single day after Elon Musk tweeted about it, it didn’t make much different since the network on WhatsApp is billions of users.

It would be hard to shift billions of people within a matter of days to another platform. That is where WhatsApp has a very strong strategic advantage.

Need vs ‘good to have’ is another dimension for how strong network effects will be. Going through Instagram and Facebook feed is a ‘good to have’ thing. Messaging and chatting to people is a real need. That is why you keep hearing about people shutting down their social media account, but no one talks about moving out of messenger. It’s easier to shift out of a network which provides a ‘good to have’ thing.

Switching costs work differently when it comes to learning curve in enterprise vs b2c products. In the enterprise products, the higher the learning curve, the harder it becomes to switch for a company once employees have learnt it. In b2c products, the easier it is to learn something, the higher is the chance of more people joining it and creating network effects.

Beyond B2C products, switching costs also come from financial and emotional aspects, but they aren’t relevant for network effects that much.

Any person building an Internet product should actively think about network effects because of all of the reasons above. I am going to list down some diverse examples for you to get the point across better.

Smartphones

Smartphones have made the network effects of the internet even stronger than the PC era. We can look at different aspects of switching costs of a smartphone network:

Smartphones have direct network effects, which are stronger.

Smartphones have high frequency usage, i.e. 100-200 times a day.

They have become a need because of app ecosystem.

Smartphones also are quite intuitive, compared to PC/computers.

Amazon.com

Search and recommendation systems built using data from millions of people using Amazon makes it a far better product

Ratings and reviews are another aspect on how network effects make the product discovery and decision making better.

Uber/Ola

More users —> more ratings on riders and drivers —> better user experience for a new person using Uber because the chances of finding a good rider/driver increases.

Another aspect is related to real time demand and supply matching

So what products are you building today, and where are you building network effects? If you aren’t building network effects, its time to rethink your strategy.

Covering other sources of competitive advantage for Internet products in the next post, stay tuned!

Thanks,

Deepak

https://www.elon.edu/u/imagining/time-capsule/150-years/back-1870-1940/

A Treasure Trove . Keep it up . Bookmark ppl .

Insightful article! Thanks for sharing!